High Net Worth Individuals often show interest when they hear about “no income taxes”. However, it is more common for countries to increase income taxes and impose wealth taxes on their tax residents.

For instance, the United States (US) is one of the two countries that have citizenship-based tax.

Regardless of where a US tax base is, they are obligated to file their tax returns and pay income tax to the US government each year.

Is it Possible to Live in a Country with No Taxes?

Benjamin Franklin’s famous quote from 1789, “In this world, nothing is certain except death and taxes,” is often associated with US citizens. However, it does not necessarily apply to other nationalities.

There are countries that do not impose taxes on their citizens yet still generate significant government revenue.

Governments can generate revenue from various sources, such as state-owned businesses, like oil and mineral exports, tourism, real estate, and other industries.

They can also charge taxes for specific services, including company registration, annual audit fees, residence permits, car licenses and registration, and tolls.

Taxes are not the only way for a country to generate revenue. Property tax, personal income tax, or corporate tax can all generate significant annual revenue in income tax-free countries.

Stamp duty for sales, monthly rates and levies on municipal services, and energy, water, and gas usage, if they run through a state enterprise, are also common in tax-free countries.

Value Added Tax (VAT) is another way for governments to generate revenue on certain goods and services. It is a type of consumption tax, making it popular in countries with no income taxes.

The tax is based on how much you spend rather than how much you earn. Therefore, you do not pay personal income taxes on your income, but rather on your spending.

Best Tax-Free Countries Using Citizenship by Investment

Many countries offer citizenship through investment programs, and one of their most attractive features is their low or zero-tax laws.

While the team at Global Residence Index doesn’t provide tax advice services, they collaborate with some of the best tax advisors in the world to help you build an effective strategy for reducing your taxes, possibly to zero.

Governments of income tax-free countries make their citizenship by investment programs more attractive to investors by offering them the potential for reducing their personal income tax. This can be a crucial factor when comparing different programs.

To obtain tax residence in zero-tax countries, the standard practice is to spend more than 183 days per year physically present in the country.

However, there are exceptions, with some countries allowing special allowances for homeowners or reducing the physical presence requirement through application.

The next section includes information on the best tax countries that GRI recommends for consideration as potential tax havens or for their very low tax regimes.

Antigua and Barbuda

Antigua and Barbuda, the former British overseas territory, are famous for their 365 beaches, giving visitors the option of spending time on a new beach every day of the year.

Additionally, these low-tax countries boast zero income tax policies, meaning residents can enjoy a tax-free lifestyle without worrying about taxes on wealth, inheritance, dividends, and capital gains.

The Value Added Tax (VAT) in Antigua and Barbuda is 15% and is applied to most goods and services, including imports. However, essential items such as food, medical supplies, educational materials, and certain exports are generally exempt from VAT.

Antigua is a popular destination for hundreds of companies that register and incorporate under the International Business Corporations (IBC) act. These companies are exempt from paying corporate income tax and tax on real estate, securities, and other assets for fifty years.

High Net Worth Individuals looking to invest in the country can obtain a second passport starting at a $100,000 contribution plus a $30,000 government fee.

The Antiguan passport is ranked thirty-first in the world and has visa-free travel to over 150 countries and territories, including the UK, Europe’s Schengen area, South Africa, Kenya, Hong Kong, South Korea, and Singapore.

Saint Kitts and Nevis

Saint Kitts and Nevis offers a citizenship by investment program with the strongest passport compared to other Caribbean countries.

The oldest program passport allows visa-free access to over 156 countries and territories. While Saint Kitts and Nevis is not a tax haven, there are significant tax benefits to becoming a tax resident.

As a tax resident, an individual can avoid paying taxes on capital gains, inheritance, and wealth taxes. However, the income tax policies are complex in Saint Kitts and Nevis. Non-tax residents, meaning citizens who don’t live in the country, don’t have to pay taxes on income or inheritance for residents and non-residents when not working for a local company.

For individuals employed by a local Saint Kitts company, the taxation rate is 3.5% between $370 to $2,405, 10% between $2,405 to $2,960, and 12% over $2,960 per year.

Additionally, there is a 5% social contribution from wages earned in the country. If a non-resident receives dividends, interest, and royalties from sources within Saint Kitts and Nevis, there is a withholding tax of 15%.

Value-added tax (VAT) is 10% for all tourism-related activities and 17% for other VAT items in Saint Kitts. Companies have a 33% tax rate on their worldwide profit. However, companies that work exclusively abroad can be exempt for up to fifteen years.

An investment of $125,000 is required to be made in the Sustainable Growth Fund by an individual before the end of June, after which the amount will be increased to $150,000. A family of four can obtain citizenship by investing $170,000 right now, but it will increase to $195,000 after July 1, 2023.

Vanuatu

Vanuatu, a South Pacific island, is becoming increasingly popular among international business persons, entrepreneurs, and remote workers who wish to relocate.

The country has a tax-free policy on income earned from a salary, dividends, pensions, and other sources, making it an attractive destination for new tax residents. The primary tax for individuals in Vanuatu is a 12.5% tax on rental income from properties located within the country.

Companies that operate in Vanuatu can enjoy a tax exemption on their annual profits for up to twenty years, with an annual license fee of $300.

The Value Added Tax (VAT) on most goods and services supplied and imported to Vanuatu by registered persons in the course of a taxable activity is 12.5%.

Individuals who are tax residents of Vanuatu do not need to submit an annual personal tax return to the island’s customs and inland revenue department. However, they can obtain a tax clearance certificate from the department if needed.

The Vanuatu citizenship by investment program offers investors an opportunity to become citizens by contributing $130,000 to a local development fund. The country’s passport allows visa-free access to 97 countries and territories worldwide, making it an excellent place to live and work permanently.

Residence and Citizenship by Investment Low Tax Country

Although these countries are not tax-free, they offer special tax programs.

Malta

Malta offers the Exceptional Investor Naturalisation program, which is the only fast-track citizenship by investment program in the European Union.

This program allows individuals to become tax residents in countries with low-income taxes and apply for a special tax residence status, known as the Global Residence Program (GRP).

Through this program, individuals can enjoy a flat tax rate of 15% on foreign income remitted to Malta with a minimum tax liability of €15,000 per year. The GRP program is available to EU and non-EU citizens who meet specific criteria.

To be eligible for the GRP, an individual must not be a Maltese national and should not have been a resident of Malta for the previous five years. Additionally, the individual should have a minimum annual income of €100,000 or assets worth at least €500,000 and must purchase or rent a property in Malta.

Greek Golden Visa and Non-Dom Program

Greece levies an income tax on its citizens, but it offers a special tax regime for Non-Domiciled (Non-Dom) Individuals to attract high-net-worth individuals and encourage investment in the Greek economy.

Eligible individuals can benefit from a flat tax rate of €100,000 per year on their foreign income, including income from sources such as dividends, interest, and capital gains.

Non-Doms’ foreign income is not subject to Greek income tax, except for income earned in Greece. Another option is that pensioners can become tax residents in Greece to enjoy a flat income tax of 7% on their foreign pensions.

The Greek Golden Visa program allows investors to obtain permanent residence by investing €250,000 to €500,000 in real estate or €400,000 in other qualifying investments.

Portugal Golden Visa and Non-Habitual Residence Program

Portugal is not usually considered a low-income tax country. However, there is a program called the Non-habitual residence (NHR) that can significantly reduce taxes for Non-EU residents.

The NHR program offers eligible individuals a flat income tax rate of 20% on certain types of income, including foreign pension income, capital gains, and specific employment and self-employment income.

The program also provides exemptions for high-value-added and scientific and technological activities. Pensioners only need to pay income taxes on 10% of their foreign-based pensions.

To qualify for the program, an individual must spend more than 183 days per year in Portugal or have a dwelling in Portugal that is considered their habitual residence.

The Portuguese Golden Visa program is also a popular route to residence, leading to citizenship after five years and minimal physical presence.

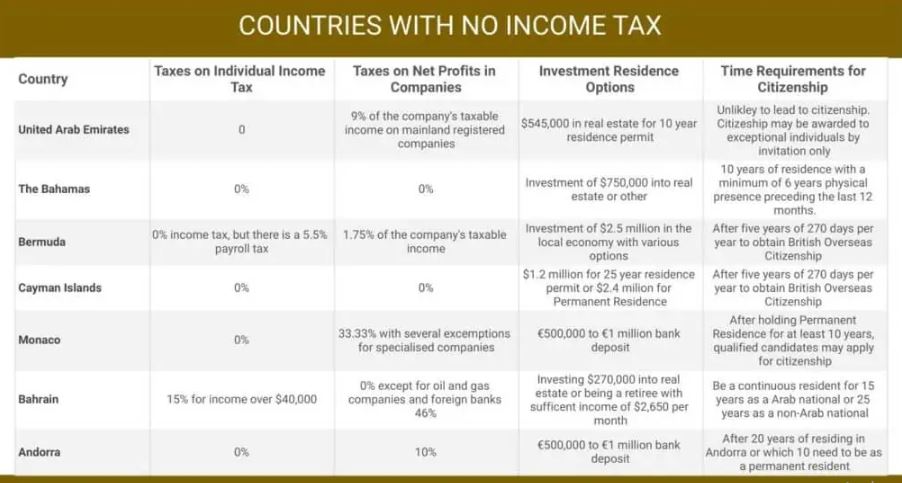

Other Popular Residence by Investment Countries with No Income Tax

It can be exciting to become a resident of other countries that do not impose income taxes. Some of these countries may offer a path to citizenship, while others may not. Regardless, they can be appealing options for financial and lifestyle reasons.

In today’s world, it is challenging to find a country that does not impose personal income tax. Governments around the world are increasing income tax rates. However, our team can assist you in legally reducing your taxes by obtaining a second citizenship or Golden Visa residence.

If you are interested in any of our programs, we invite you to sign up for our free consultation.

FAQs

What is a tax resident, and how is tax residency calculated?

The general rule is to live in a country for 183 days yearly.

Will I be taxed if I become a citizen using the citizenship by investment program?

No, unless they are tax residents, citizens of investing countries are not subject to taxes. Many, though, are tax-free nations.

If a country has no income tax, how can it operate effectively?

State-owned businesses, corporate taxes, value-added tax, income from citizenship contributions, and other levies will all provide income for the government.

How do I stop paying taxes as a US citizen?

US citizens must possess a second passport and citizenship. In order to be completely exempt from paying US taxes, they must then renounce their US citizenship. If they do not already reside in the nation of their original citizenship, they must also get a residency permit on their second passport.

![Free 5G Government Phones [How to Apply and Get] Free-5G-Government-Phones-pic](https://takeyoursurveys.com/wp-content/uploads/2024/05/Free-5G-Government-Phones-pic-150x150.jpg)